RSI

By TechGuy - December 04, 2017

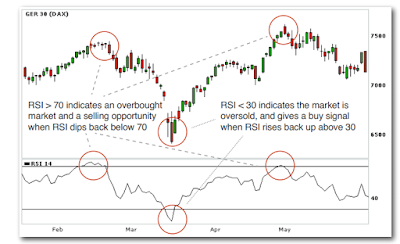

The RSI or Relative Strength Index is an indicator that measures the strength of all upward movements against the strength of all downward movements, and identifies turning points by indicating overbought and oversold levels. In trending markets, it can detect momentum change; while in ranging markets, it can spot overbought or oversold conditions. The RSI gives a reading between 0 and 100. If it is greater than 50, the upward force is stronger than the downward force, and if it is below 50, the downward force exceeds the upward force. For us to derive any signal from the RSI though, we normally look for readings greater than 70 or 80, or below 30 or 20. An RSI above 70 indicates that the instrument we are looking at is overbought, pointing to a potential sell opportunity. A more conservative trader may wait for the RSI to exceed 80 before selling, as this is considered an even stronger overbought signal. By the same logic, the opposite is true when the RSI is low – an RSI below 30 indicates an oversold market and gives a potential buy signal, while an RSI below 20 gives an even stronger buy signal.

For example, if RSI is rising above 70, which is your preferred RSI reference level, you may choose to sell the instrument when the price turns back down below the reference level of 70, placing your stop loss just above the most recent high. Note that a common mistake is to sell the instrument as soon as the RSI reaches your overbought level, and not wait for it to move back down. This can be a costly mistake as the RSI can continue to move up with the price, so always wait for a move lower before getting in. Again, the exact opposite is true if prices are moving in the other direction; when the RSI reaches or passes below your oversold level and then rises back up above it, this can be considered a buy signal and you may choose to buy the instrument, with a stop loss below the most recent low. Most trader’s use 70 as their overbought reference level and 30 as their oversold level, and the most common parameter setting for the RSI is period 14. However, whatever levels you use in your trading, you should still stick to the rules we just mentioned, waiting for the RSI to come out of the extreme zones before acting.

1 comments

nice

ReplyDelete